[CW25] G7 Critical Minerals agenda; Copper’s comeback as juniors surge; and Midstream heats up

Alright, alright, there is nothing more ‘critical’ than a war, we completely agree. But nevertheless, we shouldn’t ‘cease’ discussing our Critical Minerals, especially because they play a fundamental role in the new world order.

Chapter 1: G7 Critical Minerals agenda

The single most important thing for you to keep in mind is the latest G7 meeting held in Alberta, Canada.

Before deep diving, a brief recap on G7’s relevance: (i) their members are Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States, (ii) that combined represent ~45% of the global GDP.

To our Critical Minerals world, they are the nations hosting the vast majority of OEMs outside of China, with a special emphasis on EV (Electric Vehicle) manufacturers and Defense contractors (which is becoming hotter and hotter, and you can see in all media outlets — a.k.a. War).

Highlights of the G7 Statement

Speed of transmission: The ‘communiqué’ instructs export‑credit agencies and development banks to prioritise projects that “reduce single‑supplier dependency.” That instantly changes lenders’ risk models and pushes cheap capital toward non‑Chinese assets as early as the next funding cycle.

Midstream focus: Unlike past statements, the plan zeroes‑in on processing and recycling, not just new mines. That attacks the true choke‑point (China controls > 80 % of downstream capacity in many value chains) and accelerates Western/Allied midstream build‑outs — exactly where OEMs feel the pain today.

Geopolitical leverage: The wording (“standards‑based mineral markets that reflect full extraction costs”) telegraphs future tariff or carbon border-adjustment tools. That provides governments a ready switch to prefer ‘allied’ (or geopolitical independent) supply if relations deteriorate further with Beijing or Moscow.

General coordination: Procurement rules, financing criteria, and ESG standards, setting the defacto terms for most of the capital that flows into mining, refining, and recycling projects worldwide.

The hidden angle most people missed

One paragraph buries a commitment to “support circular economy solutions in critical minerals.” Internal EU modelling shows urban‑mined cobalt and nickel could meet up to 42% of 2050 demand. By bringing recycling into the same tent as primary mining, the G7 just signalled that scrap handlers and battery recyclers will qualify for the same cheap capital pools as greenfield mines — hugely important for closing the looming supply gap without blowing out environmental footprints.

Our brutally honest concern? At this stage, and considering the projects we met and thoroughly studied, it’s extremely unlikely (not to say impossible) that recycling will achieve the same output as traditional mining/processing.

Our takeaways

We should expect a significant reduction in the cost of capital (which is currently the largest bottleneck for project developers) for projects that (i) sit in G7 countries or in allies / jurisdiction-friendly nations, and (ii) shall cover refining, conversion, or recycling (the full scope). In our view, the main instruments to achieve it could include subsidized debts and offtake guarantees (which we should already account for in our equity valuations).

The plan is effectively a green light to sign long‑dated offtakes outside China and count on official export credit coverage, de-risking projects as much as possible.

The ‘communiqué’ creates cover to fast‑track permitting (watch for more FAST‑41–style inclusions in the U.S. and mirror schemes in Europe and Canada). It also sharpens the incentive to harmonise lifecycle‑emission reporting — an essential pre‑condition for cross‑border ‘green’ trade deals.

Chapter 2: Market Update

Copper

Let’s start with the undisputed heavyweight of the energy transition: copper. The week was flooded with optimism, investment, and a dose of bold futurism:

Resolution Copper finally got the U.S. Forest Service to republish the Final Environmental Impact Statement (FEIS), signaling serious forward momentum for the billion-dollar Arizona-based project. After a decade of red tape and negotiations with tribal communities, this signals the green light for an underground empire that could inject $1 billion annually into the local economy. Environmentalists may cringe, but investors are grinning.

Vale has its sights set on doubling copper production by 2035, kicking things off with the Bacaba project in Brazil. $290 million gets you 50,000 tons annually from 2028 onward. Ambitious? Yes. Realistic? Only if Vale manages to navigate Brazil’s notoriously complex permitting labyrinth.

Lundin Mining made its intentions clear during its Capital Markets Day, revealing a push to join the global Top 10 copper producers. Their math is compelling: $3.7 billion revenue by 2025, $220 million to be returned to shareholders, and low-cost expansions in Chile and Brazil. All this, while slashing emissions. Not a bad PowerPoint at all.

And then there's Finlay Minerals, Nicola Mining, and Karelian Diamond Resources, all staking new claims or revving up drill rigs. Whether in British Columbia or Northern Ireland, the message is clear: junior explorers are back in fashion.

Meanwhile, Alloy Enterprises upped the game on tech innovation by integrating copper into its additive manufacturing process, targeting AI server farms and data center cooling. Apparently, a major step towards thermal superiority in the digital era, and a great new ‘demand’ for copper.

Copper is evolving to become a strategic backbone of modern civilization. The geopolitical weight behind permitting decisions, corporate capital allocation, and junior exploration funding is evidence of copper’s upgraded role.

Lithium

Chevron bought up over 100,000 acres in the Smackover Formation, joining the growing list of oil majors pivoting into lithium. With TerraVolta and East Texas Natural Resources as partners, it’s a bold bet on U.S. lithium independence and DLE (direct lithium extraction) scalability.

The U.S. government expedited Controlled Thermal Resources' Hell’s Kitchen project via FAST-41 status, attempting to breathe new life into a legally beleaguered but strategically vital brine-based operation in California’s Salton Sea.

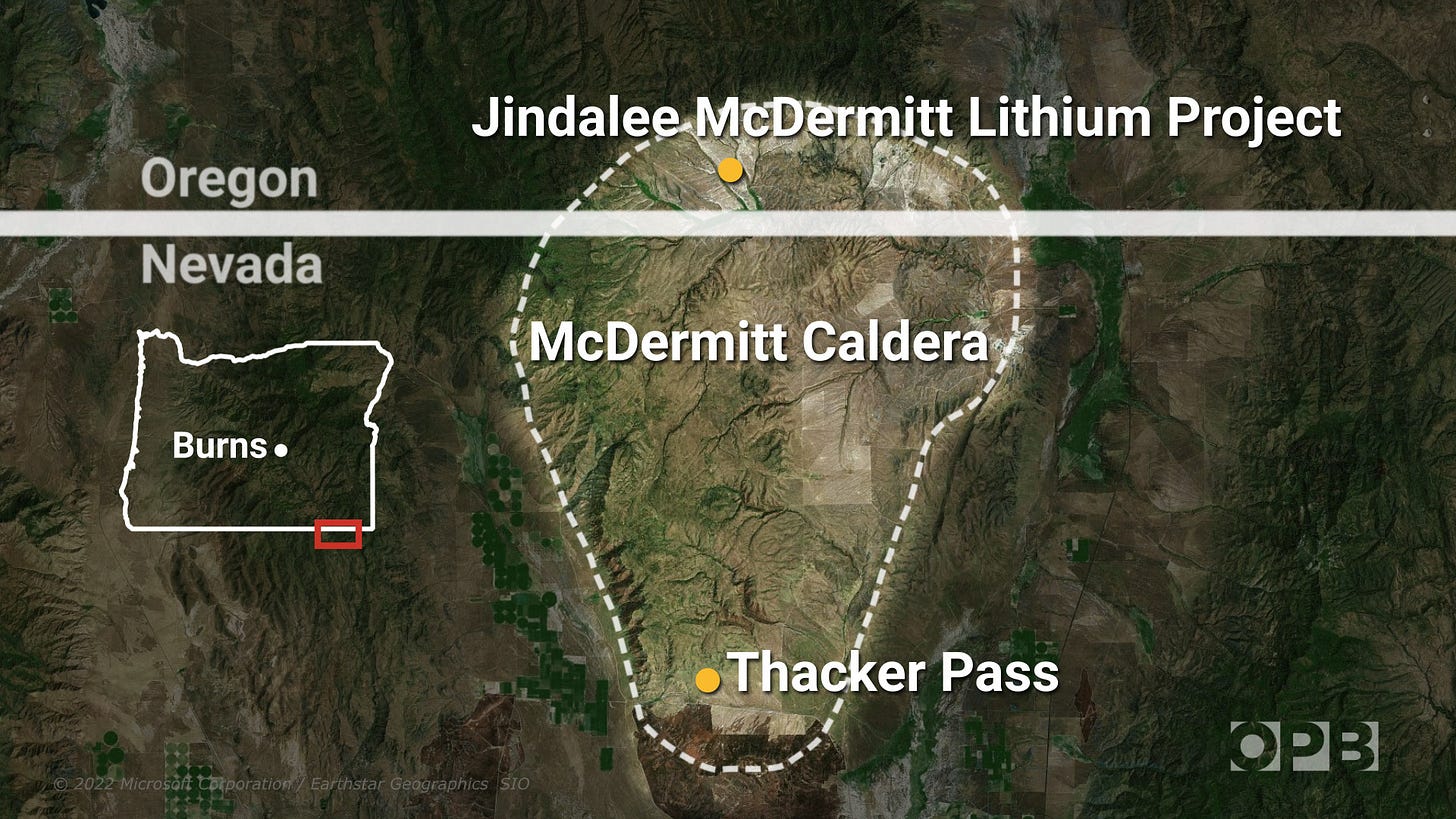

In an announcement that may sound like science fiction, geologists declared the McDermitt Caldera — an ancient supervolcano — to host the world’s largest lithium deposit, potentially worth over €400 billion. Cue the gold rush. But don’t forget: this is sacred tribal land. The protests and lawsuits are only just beginning.

The U.S. lithium strategy is crystallizing around three pillars: oil money, brine technology, and geological jackpots. But the social license to operate is the ‘Achilles heel’. The energy transition may be green, but its process won’t be ‘bloodless’.

Rare Earths

China is flexing its muscles again, restricting rare earth exports with military applications. The U.S. may still get magnets for EVs, but not for fighter jets.

In response, Critical Metals Corp. secured a $120 million EXIM loan to fund its Tanbreez project in Greenland. 85,000 tonnes of REE concentrates per year, scaling to 425,000, is no small feat.

Meanwhile, Torngat Metals in Canada scored $165 million to push forward its Strange Lake heavy rare earths project, with construction set for 2026. The kicker? Indigenous partnerships and domestic separation capacity.

Europe is doubling down on recycling, with urban mining potentially meeting 42% of cobalt demand by 2050. If the EU actually walks the talk, it might build the world’s first real circular REE economy.

Refining, not mining, remains the weak link. Everyone wants to dethrone China in rare earths, but without separation plants and magnet manufacturing, it’s all bark and no torque. That said, the money is finally showing up. And so are the laws.

Critical Minerals and Geopolitical Overview

India made headlines twice this week, and not just for cricket:

The country's National Critical Minerals Mission (NCMM) is off the ground, backed by 1,200 exploration projects and a serious ambition to reduce Chinese dependency. From skill development to regulatory overhaul, it’s a whole-of-government push. The subtext? India wants to play in the same league as the U.S. and the EU.

A separate Quad-led proposal would place India at the center of a Rare Earths Processing Hub for the Indo-Pacific, combining Australian supply, Japanese tech, and American capital. If this coalition holds, China’s grip on magnet metals could finally face real competition.

Across the Atlantic:

Canada received a warning from its own Climate Institute: shape up or miss out on $100 billion in critical mineral investment by 2030. It’s not just about having the resources; it’s about policy speed, permitting clarity, and respecting Indigenous land rights. Otherwise, other players will eat their lunch.

Oklahoma surprised everyone by emerging as a potential U.S. processing hub. Thanks to Westwin Elements' nickel refinery and some proactive state policy, the unlikely candidate is making moves.

This week solidified a strategic trend: minerals are diplomacy. Nations aren’t just digging for economic reasons; they’re redrawing geopolitical fault lines. The risk? Everyone wants upstream assets, but midstream and downstream infrastructure are harder to build. Watch for who cracks the refining and recycling bottlenecks first.

Things You Probably Missed

Alloy Enterprises' copper-based thermal management solution for AI data centers might sound niche, but it’s a canary in the mine for new use cases of critical minerals. This is not your granddad’s copper wire.

Electrified cryogenic electron microscopy (eCryoEM) by UCLA researchers is giving us real-time imaging of lithium-metal batteries during charge cycles. Think of it as an MRI for battery chemistry.

Korean researchers achieved 92.7% retention in sodium-ion batteries after 400 cycles using a lithium salt additive. It’s early, but SIBs might finally be catching up in the performance race.

And yes, someone blew up their Florida garage due to a lithium-ion battery explosion. A reminder: the future is electric, but it still needs better ‘fire insurance’.

Takeaways

This week was a turning point. Copper is having a breakout year, juniors are resurgent, and the global North is finally putting its money where its minerals are. But let’s not kid ourselves: we’re still early. The transition from announcements to deliveries—from drill targets to functional refineries—is where dreams either compound or collapse.

And finally, remember: metals may be critical, but timing is everything.

Stay ahead with the Critical Minerals Journal — where insight meets impact.