[CW23] Investment opportunities are flying under the radar: Copper, magnets & uranium and more

Mind the whiplash

Copper futures flirted with $4.90/lb, Beijing tightened its fist around rare-earth exports (again), President Trump reached for the Defense Production Act like it was the TV remote, and Ontario slammed CAD 3.1 billion on the table to keep processing at home.

If the critical-minerals universe had a soundtrack this week, it would be a mash-up of Wagner’s Ride of the Valkyries (for the drama) and a high-speed drill bit hitting sulfide ore (for the industrial groove).

In other words: loud, relentless, and absolutely impossible to ignore.

Chapter 1: Detailed breakdown by category of Critical Minerals

1. Copper

Copper closed the week hovering around $4.90/lb on the CME, up roughly 5 % in five sessions as traders digested a pile-up of bad news on the supply side.

Yet the rally has a distinctly hollow ring.

The spot–three-month contango, a proxy for “please-ship-me-cathode-now” panic, widened even as China’s latest PMI printed contractionary.

Translation: fundamentals, not macro euphoria, are yanking prices higher.

Arizona Sonoran Copper’s Cactus project

It quietly illustrates the new North American financing math.

By hiring Hannam & Partners (the boutique that packaged SolGold and Adriatic), ASCU is signaling it will seek project debt in London rather than rely purely on offtake pre-payments or Washington’s Title III funds.

The target is >100kt Cu cathode per year by 2028; that would make Cactus one of only three green-field SX-EW builds scheduled inside the US this decade.

Competition for EPC contractors — and acid — will be fierce.

Smelters are the new bottleneck

Sinomine’s decision to mothball the 240kt Tsumeb complex in Namibia because it cannot source high-arsenic concentrates is a canary: the world has too many custom smelters and too little clean concentrate.

When you add delays at Teck’s Quebrada Blanca 2 and an extended shutdown at Kamoa-Kakula (both feeding “clean” charge), the arithmetic for sulphide concentrates looks dire.

Europe’s first CRMA “Special Strategic” copper mine

Nussir in Norway went from local controversy to Brussels poster boy in one week.

The badge unlocks EIB debt guarantees and export-credit cover, shaving 150–200bp off the cost of capital and turning what was once viewed as a remote Arctic bet into a cross-border clean-energy linchpin.

Expect copycat applications from Spain, Portugal, and perhaps even Serbia.

Technology swing factor

Chilean start-up Ceibo needed just three months to erect a demonstration plant at CMSG and has already plated its first cathodes using low-temperature sulphide leach.

If leach-plus-SX works at scale, juniors pinned by refractory sulphides could leapfrog $1bn concentrator CAPEX.

Peru’s nervous confession

Lima’s acknowledgement of large-scale informal copper mining (“informal” is code for untaxed and often violent) finally puts a spotlight on a shadow market some traders think already ships 200–250kt per year (i.e., a “ghost mine” the size of Las Bambas).

Higher prices mean more illegal output, more social flashpoints, and uglier ESG audits for buyers.

For all the talk of demand, the 2026–2028 balance sheet will pivot on operational uptime and mid-stream bottlenecks.

Traders who nailed the first-half price pop did so by watching concentrate TC/RC negotiations, not Chinese grid data. Keep doing that.

2. Lithium

The lithium narrative looks like a biotech roller-coaster — lab euphoria at the top, political vertigo in the trough.

Battery X Metals

Battery X Metals pulled off a real-world resurrection: its Prototype 2.0 “rebalancing” rig coaxed a worn Nissan Leaf pack back to full nominal capacity, cell by cell.

If even 10 % of out-of-warranty EV packs can be revived, the global gigawatt-hour demand curve just bent downward, and scrap values up.

Standard Lithium + Telescope Innovations

Combined, they quietly solved a chemistry bottleneck most solid-state evangelists gloss over: scalable lithium-sulfide (Li₂S) at low temperature from brine-derived LiOH.

Sulfide is the feedstock of choice for argyrodite electrolytes.

Every gram made in Arkansas is a gram not imported from Qinghai.

Policy whiplash in Bolivia

A Potosi court froze $2bn DLE contracts signed with China’s CBC consortium and Russia’s Uranium One on the grounds of inadequate Indigenous consultation.

It’s a stark reminder that the political cost-of-capital in the Lithium Triangle can jump overnight — even when Beijing writes the cheque.

Arkansas becomes the Saudi Arabia of brines

Exxon’s Saltwerx division applied for a 2.5% royalty on its Pine Unit, copying the template the state set for Standard Lithium / Equinor just a week earlier.

A statutory royalty solves a key perception problem: investors can now model state take neatly, rather than fear ad-hoc levies.

Brussels pokes the Balkan bear

In a move that stunned local NGOs, the European Commission added Rio Tinto’s Jadar lithium project in Serbia to its CRMA strategic list, despite the Serbian government’s own permitting freeze after mass protests in 2022.

Europe clearly prefers lithium that travels by rail, not Suez.

The bull thesis is no longer simply “EVs need lithium.” It’s a race between chemistry that stretches the supply (rebalancing, recycling, sodium-ion substitutes) and politics that strangles it.

In that clash, project IRRs will hinge on your lawyers as much as your metallurgists.

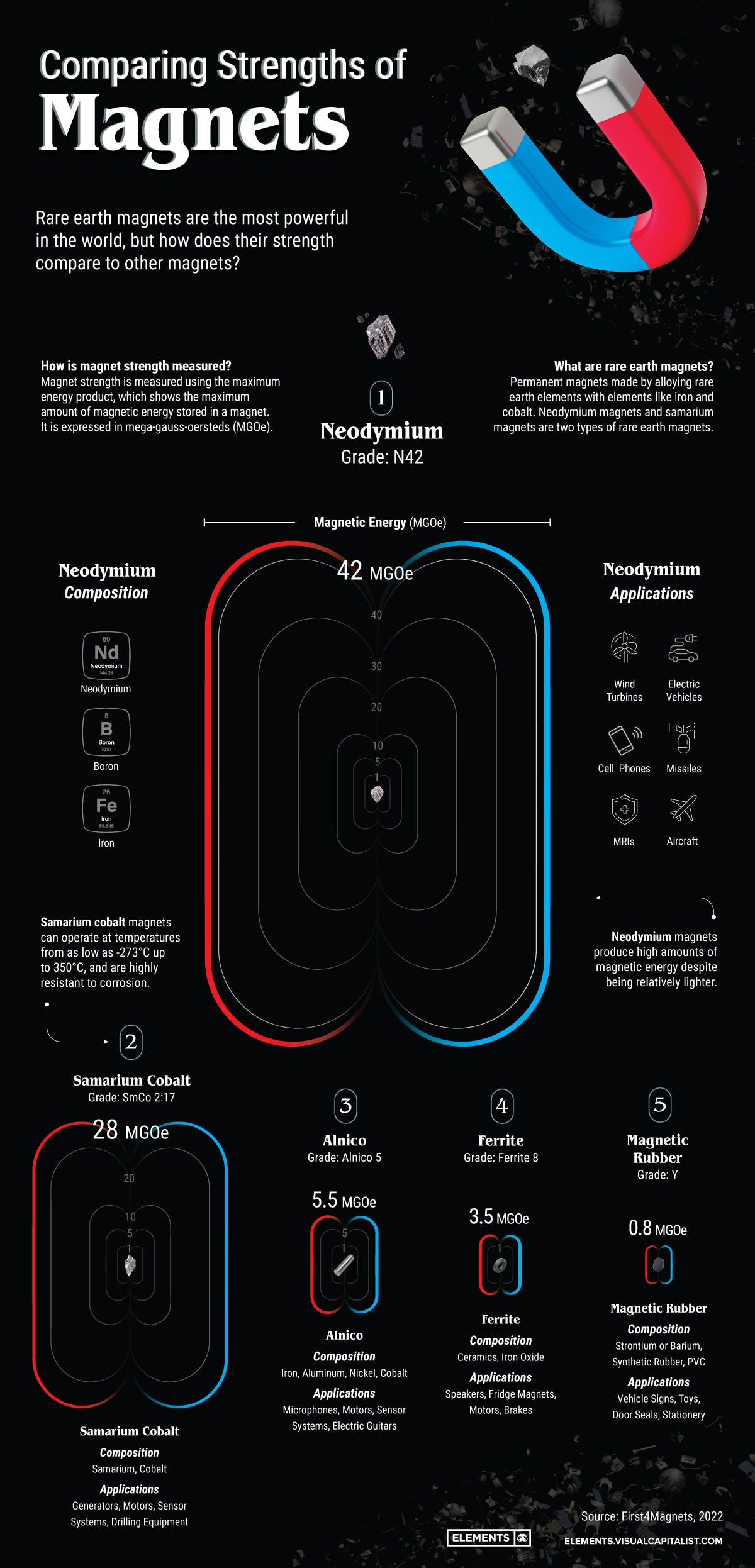

3. Rare-earth (magnets)

Rare-earth permanent magnets have morphed from an obscure material science niche into a board-level existential risk — fast.

The trigger

Beijing’s new rare-earth export license regime throttled outbound flows just as US automakers were ramping Mach-E, Hummer EV and F-150 Lightning motor assembly.

One industry letter to the Trump administration warned plants could “go dark in weeks” without Chinese NdFeB.

China’s leverage just ballooned

A €216bn deposit — 470,000t of medium-to-heavy REEs — surfaced in Yunnan (China) in January and is now in the resource-estimation phase.

Even if only half proves recoverable, China moves from 70 % to >80 % control of HREE reserves overnight.

An unexpected white knight: Kazakhstan

Nur-Sultan’s disclosure of a Karagandy-region REE find (early estimates put it among the world’s top-three non-Chinese resources) offers Washington a politically palatable supply hedge — if the US can craft a financing package fast enough to dissuade Chinese tolling offers.

India’s subsidy play

New Delhi is finalizing production-linked incentives to bridge the 20–25 % cost gap between locally sintered magnets and Chinese imports, plus stockpile top-ups for strategic sectors.

Expect tender guidelines within the quarter, mirroring the PLI scheme that jump-started domestic PV cells.

Automotive Tier-1s are scouting magnet start-ups the way OEMs once hoarded chips.

Any Western junior that can show pilot-scale Dy or Tb separation — let alone sintered magnets — will find itself courted by Detroit and Brussels.

4. Nickel

While nickel sulphate prices sagged on Indonesian oversupply headlines, North American nickel suddenly got sexy.

Atlantic Nickel

Atlantic Nickel paraded its smelter-free awaruite flowsheet at Benchmark’s GIGA USA, pitching 75% Ni concentrate upgraded via magnetic separation — no matte, no sulphuric acid, no Indonesian carbon footprint.

Automakers love the IRA-compliant angle; ESG funds love the CO₂ math.

Clarios’ $1bn antimony-recycling plant (Indiana, Texas or Utah shortlist)

A true lesson in policy leverage.

By marrying the Inflation Reduction Act’s production tax credit with Trump-era defense rhetoric on antimony munitions, the battery giant de-risked a feedstock most investors ignored a year ago.

If the model works, expect copycat “critical-mineral recovery” factories for germanium, gallium, and even tellurium.

Ontario throws money — and time

A dual-track, CAD 3.1 bn package for Indigenous partnerships plus a CAD 500 m processing fund, wrapped in a “One Project, One Process” approval mantra, essentially halves permitting timelines in the Ring of Fire and pours capital into mid-stream plants.

Juniors with compliant NI 43-101s now have a shot at becoming processors, not just drill plays.

Mid-stream processing inside “friendly” borders commands venture valuations the underlying metal prices no longer justify.

The catalyst is regulation: once legislators dangle point-blank tax credits, recycling suddenly beats green-field CAPEX in IRR league tables.

5. Uranium

While headlines fixated on copper, nuclear power quietly gained its most unlikely cheerleader: Silicon Valley.

Meta’s 20-year PPA with Constellation

The deal locks in 1.1GW of zero-carbon output from the Clinton plant in Illinois starting 2027 — the first time an operating US nuke has secured data-center-style contracted revenue.

The deal essentially underwrites the plant’s license-extension costs and adds a 30MW uprate.

For uranium miners, the signal is golden: utilities will need fresh term contracts.

Regulatory velocity picks up in New Mexico

FAST-41 status for Laramide’s Crownpoint-Churchrock and La Jara Mesa trims an estimated 18 months off federal reviews, pulling first ISR production into the late-decade window when SMR demand ramps.

FAST-41 also grants a single federal agency “shot clock,” reducing inter-bureaucracy turf wars.

Wyoming consolidation

Premier American Uranium’s all-stock acquisition of Nuclear Fuels aggregates 104k acres across Powder River and Great Divide — enough for multiple ISR hubs and spoke satellite wells.

Haywood puts the merged entity at C$102m — roughly one-tenth what NexGen commands for a similar resource base in Canada’s basin. Expect a rerating if spot breaks $80/lb again.

The Nordic wildcard

Aura Energy’s tie-up with Neu Horizon reinvigorates Swedish shale-hosted uranium just as Stockholm signals it may repeal its 40-year mining ban.

Vilhelmina shales run higher grade than Devonian alum shales, and sits next to hydropower.

Europe could host its first EU-taxonomy-compliant mine by 2032.

The tech sector’s hunger for 24/7 clean electrons cranks the demand dial far faster than SMR construction can turn supply. ISR orebodies inside stable jurisdictions (WY, NM, SK) now look like the low-beta call option on AI.

Across the board, one thread stands out:

Mid-stream leverageWhether it’s sulphide leach, lithium sulfide, magnet sintering, antimony recycling or uranium conversion, the chokepoints have migrated from the orebody to the processing hall.

Capital is following.

[Chapter 2: Connecting the dots]

Zooming out and executive cheat sheet

Inventory is the new insurance. Last week we joked about magnet rations; this week OEMs are literally counting coils. “Just-in-case” has replaced “just-in-time.” Expect working-capital spikes and margin pressure through H2-25.

Processing premium widens. From Ceibo’s leach demo to Nussir’s EU badge, mid-stream capacity is fetching IRRs that would make a cloud-software VC blush. Translatio: Incredible investment opportunities are surging in companies that combine both great resources + demonstrated processing capabilities.

Dual-chemistry hedge emerges. Sodium-ion buses in Chinese showrooms; vanadium-lithium packs for haul trucks; manganese-rich cathodes for mid-range sedans. Battery OEMs are diversifying away from pure lithium dependency, forcing miners to rethink five-year price decks.

Policy tilts protectionist, fast. Ontario’s “One project, one process,” Trump’s tariff chatter, India’s stockpile subsidies — all point to a balkanised minerals world. Financing will flow to projects with local political sponsorship, not necessarily the lowest opex.

Recycling gets real economics. From antimony to lithium to neodymium, secondary supply is finally penciling IRRs >15 % without green-premium fairy dust — helped by tax credits and landfill-gate fees (keep that in mind).

Things you probably missed (but shouldn’t)

Up-cycling plastics with copper nano-catalysts. Nature Catalysis published a 91% yield at a balmy 55°C — picture a petro-chems-lite route that adds copper demand while shrinking polymer waste.

PNNL’s single-crystal Li-rich cathode hack (vaporising Li₂O under ambient pressure) hints at EV packs shrugging off >1,000 cycles and cheaper processing. Translation: Cathode factories from Shanghai to Saskatchewan just red-lined their depreciation schedules.

AI-tuned electrolyte resurrection at Fudan: rejuvenates 96% capacity in spent LFP cells. Imagine “Battery-Boost Stations” next to fast chargers by 2030 — OEMs are taking notes.

Vanadium-lithium oxide anode charges a mining truck pack in <10 minutes, lasts 10,000 cycles. Heavy-duty decarbonization just got a shot of espresso.

Solar-thermal boron-rich lithium brines (Duke University) revealed the “alien chemistry” behind South American salars; selective extraction reagents are now in beta, opening new levers for ESG-friendly DLE.

Copper-moly porphyry 3-D resistivity mapping at Element 29’s Elida shows how AI geophysics is cutting drill costs by a third — quiet, but transformative for juniors.

Why care? Tech innovation is compressing timelines between lab poster and pilot-plant cash flow. Funding flows to whoever marries IP with a friendly jurisdiction first.

Stay ahead with Critical Minerals Journal — where insight meets impact.