In the early 2000s, conversations around the energy transition were framed around sustainability, ethics, and environmental stewardship. These narratives still matter, but the global context has shifted dramatically.

Today, transitioning away from fossil fuels is no longer about aspiration, it is about survival, competitiveness, and stability.

Climate change, geopolitical volatility, technological advancement, and resource scarcity are converging to make this transition non-negotiable.

Our economies, infrastructures, and lifestyles are now deeply entwined with this transformation. This is not a phase — it’s a structural overhaul.

And our take is that Uranium and Rare Earths (especially the Heavy REE) are ‘the power couple’ to enable it. It’s just our opinion, but we are bullish on that, and we’ll explain why 😉

Chapter 1: The Power Couple

Energy demand in the 21st century: The exponential curve

The growing appetite for Power

From 2020 to 2050, global energy demand is expected to rise by 50–75%, depending on the scenario and pace of electrification. Key drivers include:

Urbanization: By 2050, 68% of the global population will live in cities, demanding more energy-dense living and transit systems.

Electrification: Electrification of transport, heating, and industry is multiplying the need for grid-capable, low-carbon energy.

Digitalization: The proliferation of data centers, AI workloads, and IoT devices adds a stealth layer of energy demand often underestimated in forecasts.

Emerging Markets: Nations in Africa, Asia, and Latin America are increasing their energy consumption as their economies develop.

The supply dilemma

While demand surges, our ability to meet it sustainably lags behind (by far):

Fossil Fuel Limitations: Oil and natural gas reserves are not only finite, but they are increasingly politicized and environmentally costly.

Renewables Gap: Even under aggressive development scenarios, renewables like solar and wind face intermittency, land use challenges, and mineral supply bottlenecks.

Grid Inertia: The current electricity grid infrastructure in many countries is outdated and unprepared for decentralized, variable energy input.

The result: a critical supply-demand imbalance that threatens to destabilize energy security if not addressed with urgency and scale.

Where the Power MUST come from

Even in the least aggressive decarbonization scenario, we must add ~26,000 TWh of clean generation in 25 years. This is roughly the size of two present-day global power systems.

The production pathway (2025 -> 2050)

2025-2030: Scale-out & Stabilize

Solar and wind grow ~17 % CAGR, driven by cheaper modules and record auction volumes.

Grid-scale batteries leap from 240 GWh (2024) to > 1,100 GWh but provide only 6-8 hours coverage on average.

Nuclear focus: lifetime extensions of existing plants (up to 60-80 years) and first concrete for flagship SMRs in North America, Europe and Asia.

2030-2040: Deep Electrification

Variable renewables cross 50 % of OECD electricity; long-duration storage (pumped hydro, flow batteries, hydrogen) matures.

SMRs begin commercial operation, supplying island grids, industrial parks and data centers “behind-the-fence” power.

Large reactors add 120 GWe net, mainly in China, India and the Gulf. Nuclear reaches ~680 GWe globally.

2040-2050: The Balancing Act

Solar + wind head toward 60% of generation; demand plateau starts in advanced economies but surges in Africa & South-East Asia.

Nuclear’s capacity approaches 650-700 GWe — still ~10% of generation but providing half of zero-carbon firm power.

Green-hydrogen turbines pick up some seasonal swing, but uranium-fueled reactors remain the only dispatchable, high-density option that can scale globally.

Fifty-six SMR designs are now tracked by the OECD-NEA, most aiming for market entry before 2030.

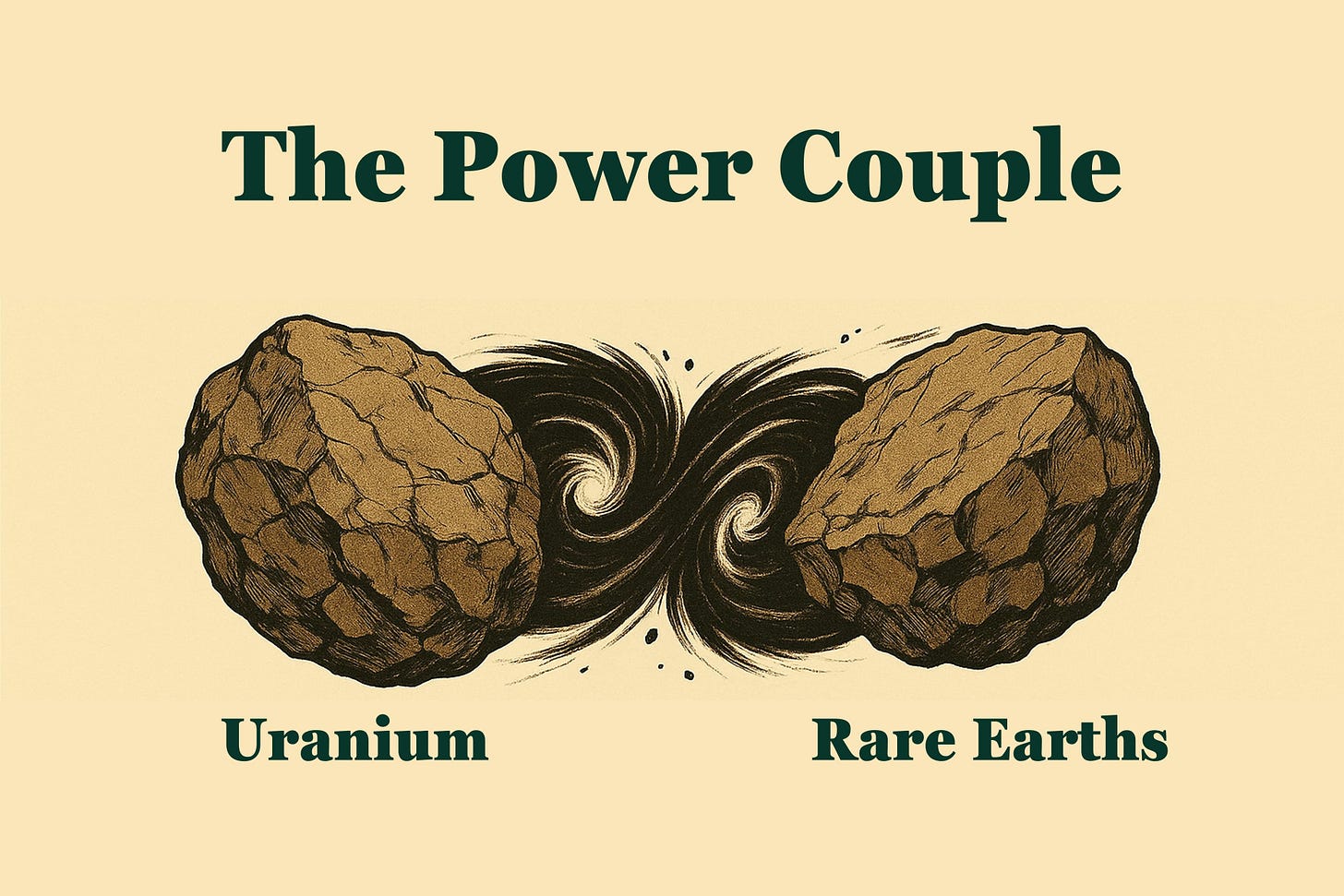

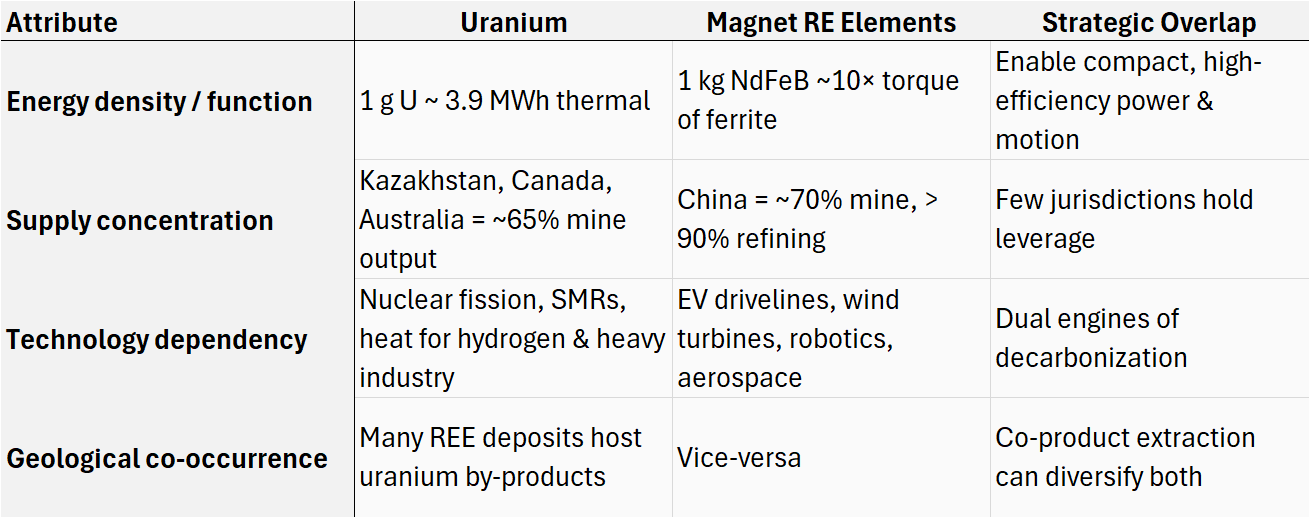

Uranium: Fuel for the Baseload Backbone

Supply tension: Secondary sources fall from covering ~12% of needs today to 4-11% by 2050; UxC sees a 40 Mlb (~15,000 tU) annual deficit by 2030 if new mines lag.

Price signal: Spot U3O8 climbed back above US$70/lb in May 2025, while enrichment hit record highs on Russian supply curbs.

Technology lift-off: 56 SMRs designs tracked by the OECD-NEA show rapid progress across licensing and financing; first-of-a-kind units before 2030 are now credible.

Without timely investment in mining, conversion and enrichment, uranium could become the single biggest throttle on clean baseload growth.

Rare-Earth Magnets: The torque behind everything that moves

Permanent magnets based on neodymium, praseodymium, dysprosium, and terbium (NdFeB alloys) run the motors of the transition: EV drivetrains, direct-drive wind turbines, robots, and drones.

Why magnets matter more than ever

Unlike combustion engines or standard induction motors, rare earth permanent magnets offer the highest magnetic strengths in the most compact formats, enabling:

Smaller, lighter systems with greater torque and energy efficiency.

Higher reliability, crucial for offshore wind farms or EV drivetrains.

Energy density, a cornerstone metric for everything from vehicles to aerospace.

Yet supply is fragile

The IEA projects magnet rare-earth demand (Nd, Pr, Dy, Tb) to double by 2040 in its Net-Zero pathway.

Supply is even more concentrated than uranium: China refines ~90% of magnet REEs and produces over 70% of mine output.

Adamas Intelligence forecasts a 48,000 tonnes annual NdFeB alloy shortfall by 2030, enough to stall >25 million EVs/year.

Direct-drive wind turbines and high-power EV motors cannot match their efficiency targets without high-grade NdFeB or next-generation HEA magnets.

Dual Criticality: Why Uranium & REEs rise together

Nations pursuing energy-secure net-zero pathways must lock in both fuels (U) and motors (REE magnets).

Policy is converging: the US, EU and Japan now classify both uranium and magnet REEs as critical, unlocking export-credit, tax incentives and strategic stockpiles.

Strategic actions needed from here

Accelerate firm-power build-out: Extend existing reactors, de-risk SMRs, and fast-track Gen IV demonstration to firm up the renewable-heavy grid.

Invest up-stream: Support new uranium and REE projects outside current hegemonies; incentivize co-mining and advanced separation.

Scale circularity: Develop magnet-to-magnet recycling and explore spent-fuel reprocessing to reduce primary demand pressure.

Secure conversion & enrichment: Western capacity for UF 6 conversion and HALEU enrichment is the Achilles’ heel of SMR roll-out.

Standardize offtake: Long-term contracting (10-20 years) gives miners the confidence to sanction capital-intensive projects.

The energy transition’s second wave demands not only more kilowatt-hours but more reliable kilowatt-hours—and the mobility to use them efficiently. Uranium and magnet rare earths form the invisible spine of that future: one fuels the reactors that keep the lights on when the wind drops; the other spins the rotors that harvest that wind and drive the electric fleet.

Ensuring abundant, diversified supplies of these two elements is therefore not optional; it is foundational to every net-zero scenario now on the table.

Chapter 2: This week’s main developments

Vietnam’s REE reckoning: From contender to cautionary tale

Vietnam just went from “the next China of rare earths” to “wait, how much REE do they actually have?”

In a bombshell court case, 23 officials and executives were sentenced for illegal rare earth and iron ore exports — $30 million worth, mostly to China.

This comes hot on the heels of the USGS slashing Vietnam’s estimated reserves from 22 million tonnes to just 3.5 million.

The fallout? Vietnam’s image as a major REE player is now shaky. But here’s the kicker: it also shows the country's increasing appetite to enforce environmental rules — something markets will need to digest fast.

Investors banking on Vietnam as a reliable REE source might want to reassess. This is both a reputational hit and a red flag for permitting risk. But it could also be a step towards stronger ESG alignment.

Lithium land grabs — deserts, brines and boardrooms

Imperial County’s Lithium Valley

At the Salton Sea conference, geologist Michael McKibben mapped reserves able to power 30 million EVs a year — using just a sliver of the region’s historic water budget. California permitting may be a hurdle, but the county smells thousands of jobs and a fresh tax base.

Arizona Lithium’s Saskatchewan splash

Phase-1 approval for Prairie — the province’s first lithium-brine producer — sends a direct-extraction unit to pad #1 (150 t LCE/yr). Curiously, the stock fell 22 % on the news: proof that investors now punish timelines longer than TikTok clips.

Codelco + Rio Tinto

The $900 m Maricunga JV gives Chile a second swing at lithium supremacy after ceding the crown to Australia in 2017. Commercial DLE is unproven at scale, but if Rio nails it, expect copy-cat Latin projects before the decade’s out.

Zimbabwe’s tax standoff

Miners beg Harare to delay a 5 % concentrate levy until 2027, pleading for time to finance local conversion. Translation: politics may force beneficiation faster than balance sheets allow.

Every greenfield brine now comes with a built-in processing plant — or it doesn’t get funded. Chile has read that memo; Zimbabwe hasn’t.

Prices, paradoxes and the market’s uneasy ceasefire

Lithium carbonate slid to <CNY 63,000/t — a four-year low — even while demand grew 30% YoY. How? Supply outpaced it. CATL’s Hong Kong IPO (US$ 4.6 b) says Chinese cathode majors assume the glut is temporary.

Rare-earth oxides, by contrast, held flat as miners refused discounts and magnet producers haggled for drops. Expect slight declines if auto orders stay anemic into Q3.

Remember our call two weeks ago that lithium “price turns were coming”?

Turns out, we may need to wait for 2030-era shortages the IEA already models — unless half the 80 announced DLE start-ups actually deliver battery-grade product. Don’t hold your breath.

Circularity — the new exploration frontier

Western Digital recycles Microsoft’s datacenter hard drives, extracting Dy, Nd & Pr without a single acid bath. Acid-free leaching slashes Scope 3 emissions and inches the U.S. closer to a closed-loop magnet chain.

E3 Lithium + Pure Lithium hit 500 battery cycles with > 99.9 % pure anodes straight from Alberta brine concentrate — the first Canadian mine-to-metal proof-point.

KTH & Scania model shows circular manufacturing can cut virgin REE demand in EVs by 15%, costs by 18% and carbon by 39%. In a world of tariffs and IRA credits, those numbers talk louder than lobbyists.

Hidden angle: The Inflation Reduction Act’s 10% clean-manufacturing credit is quietly evolving into a recycling act. Follow the money, not the hashtags.

The diversification dance — and who’s leading

Rosneft’s Siberian gambit. Moscow handed the oil giant full control of the Tomtor deposit, the world’s highest-grade niobium-rich REE orebody. Expect Russia to chase 12% global market share by 2030, weaponizing magnets the way it once weaponized gas.

Neo Performance exits China. Toronto sold its last separation assets on the mainland, doubling down on a magnet plant in Europe. The message: boardrooms now price political risk ahead of capex.

China, still the 800-pound chemist. The IEA puts Beijing’s share of global refining at 19 of 20 critical minerals. Separation, not mining, is the true choke-point — and why Lynas’ heavy-oxide run mattered so much last week.

Resource nationalism is morphing into refining nationalism. Watch CAPEX flow into mid-stream assets from Oklahoma to Odisha.

Things you probably missed (but shouldn’t)

Sodium-ion EVs hit Chinese showrooms: Brands JMEV and Yiwei have baked ultra-cheap, lithium-free batteries into city cars, proving sodium’s 1/50-the-cost advantage can trump shorter range—and giving Beijing a whole new mineral to play geopolitical chess with.

Coal-ash rare-earth bonanza: University of Texas researchers discovered 11 million tonnes of REEs worth roughly US$8.4 billion inside yesterday’s “waste,” a finding that could instantly multiply U.S. reserves and turn power-plant ash ponds into the next mining district.

Reecover’s one-step europium extraction: A Franco-American startup just patented a cleaner, faster way to pull Eu (and friends like Dy) from old fluorescent lamps, slashing chemical waste and making urban mining of e-scrap look both green and profitable.

E3’s 500-cycle lithium-metal anode: By pairing Alberta brine concentrate with Pure Lithium’s tech, the partners showed DLE feedstock can power next-gen batteries—not just vanilla LFP—and positioned Canada to stitch together a full “Battery 2.0” value chain before the U.S. even wakes up.

Protein nanotubes that filter lanthanides: UT Austin scientists built bio-nano sieves that separate REEs without harsh solvents; combine this with acid-free HDD recycling and you’re basically cultivating magnet metals in stainless-steel vats.

Big picture takeaways

The Power Couple call – is it really what we are needing? In order to really shift to a new energy matrix, we’ll need to take the next step into power generation, storage (which may be more mature) and drivers (magnets). The market will adjust in all those three fronts.

China is not retreating — it’s recalibrating. A temporary lifting of REE export bans to U.S. firms was less diplomacy, more psychological chess. Its recent export surge (5,600 tonnes in March) suggests tactical selling ahead of tighter controls.

Heavy REEs are the new gold. Lynas’ breakthrough and U.S. reshoring efforts (e.g. Ucore Rare Metals’ $18.4M DoD-backed plant) signal that heavy REE capabilities are now central to national industrial strategy.

Lithium’s oversupply could flip into shortage if CAPEX dries up. Benchmark Intelligence warns of a 2030–2040 gap without significant investment.

Circular economy isn’t a buzzword anymore. The fastest-growing segment of critical minerals is not mining—it’s remanufacturing, recycling, and design optimization.

Global South is rising. Brazil, Zimbabwe, and Sierra Leone are all becoming critical nodes in the emerging multipolar supply chain.

Stay ahead with Critical Minerals Journal — where insight meets impact.

great essay, amazing work

Absolutely fascinating breakdown! The way you frame uranium and rare earth magnets as the “power couple” of the energy transition really shifts the conversation from abstract goals to concrete supply challenges and opportunities. I’m especially interested in how supply chain risks—like China’s dominance—and the pace of SMR deployment will shape the next decade.