[CW20] Important realignment and advancements on Rare Earths: Saudi ambition, U.S. execution, and China's shadow diplomacy

This week, the REE industry deserved the spotlight — and not for the usual tariff drama or policy talk. We saw a remarkable alignment of ambition, investment, and geopolitical posturing.

MP Materials and Saudi Arabia’s Maaden signed a strategic MoU to build a full-spectrum rare earth supply chain — from ‘mine-to-magnets’. In parallel, China temporarily lifted its rare earth export ban for 28 U.S. companies, offering a 90-day reprieve. Strategic olive branch or tactical smokescreen? Time will tell.

Meanwhile, Australia’s Lynas Rare Earths quietly delivered a milestone of global significance: the first commercial production of heavy rare earth oxides outside of China. And U.S. reshoring gained further momentum with two major moves: Ucore Rare Metals secured $18.4M from the DoD to build a separation facility in Louisiana, and USA Rare Earth inaugurated the country’s first fully domestic magnet production plant in Oklahoma.

Outside the REE arena, there was no shortage of game-changing developments. Avonlea Lithium’s wastewater-to-lithium tech showed the potential to meet 40% of U.S. demand without traditional mining. GM revealed plans for manganese-rich EV batteries, BASF and Group14 dropped a high-performance silicon anode, and a Wyoming data center committed to saltwater flow batteries to power AI.

Add to that a biotech breakthrough in copper extraction from Endolith, and a rare-earth-free EV motor from Canada’s Enedym, and what you get is a rapidly evolving critical minerals landscape — one that’s no longer just about digging, but designing, recycling, and strategically realigning.

Saudi Arabia enters the rare earth game. And the U.S. goes for another sprint

One of the striking news of the week: during the US-Saudi Investment Forum in Riyadh, MP Materials and Maaden (Saudi Arabia’s mining giant) announced their MoU to establish an end-to-end rare earth supply chain.

Many saw it as just another diplomatic nicety – but look deeper, it’s massive!

The deal spans the entire value chain: mining, separation, refining, and magnet production. In essence, Saudi Arabia wants to do to rare earths what it once did to oil.

This aligns with its Vision 2030 push and a $600 billion U.S. partnership that mixes defense and minerals into one formidable handshake. The Middle East just inserted itself directly into the global magnetics race.

Fun (and at the same time, unsettling) fact: In 1992, the then-paramount leader of the People’s Republic of China, Deng Xiaoping, said:

“The Middle East has oil; China has rare earths.”

The year was 1992, let that sink in. For China to make that statement with such confidence suggests that it had already been quietly developing its rare earth industry and securing supply chains for far longer.

But here's the twist: China's shadow still looms.

Shenghe Resources, a major Chinese stakeholder in MP Materials, is acquiring Peak Rare Earths in Australia. So while MP cozies up to Riyadh, its largest investor plays chess in Canberra.

And just as this unfolds, China temporarily suspends its rare earth export ban to 28 U.S. companies, offering a 90-day reprieve. Some interpret it as goodwill. Others see it as a calculated move to weaken momentum in America’s supply chain independence push.

Meanwhile, Lynas Rare Earths — Australia’s crown jewel — adds another plot twist. It just became the first company outside China to commercially produce heavy rare earths oxide (specifically dysprosium oxide) at its Malaysian facility. It’s not full commercial scale yet, but at any case, this is a remarkable milestone to the industry and serves as a reminder that there is light in the end of the tunnel for REEs diversification.

Here is a brief video of Lynas’ heavy REE separation process:

Rare earths in short:

We’re watching a three-way minerals standoff.

The U.S. is investing hard in reshoring.

Saudi Arabia wants to become a rare earth superhub.

China, still dominant, is playing both carrot and stick.

Possible implications? More government intervention, M&A deals and more supply chain localization — everywhere.

Note: it almost feels like we’re moving away from a globalized, hyper-efficient world into one of self-sustaining, strategically independent nations. Doesn’t it?

America’s recycling moment — finally materializing?

Let’s start where strategy meets sustainability: recycling.

American Resources Corporation’s Electrified Materials Corp (EMCO) just secured a vital RCRA permit to start preprocessing and recycling lithium-ion batteries and rare earth magnets at their Indiana facility.

Backed by a $900k state grant, EMCO promises to extract critical materials at purity levels of 99.5% to 99.999%.

But here’s the bigger picture: EMCO is just one node in a rapidly forming American industrial constellation. Quick recap on others in a similar path:

Ucore Rare Metals has locked down an $18.4 million injection from the U.S. DoD (Department of Defense) to build a commercial-scale rare earth separation facility in Louisiana. It’s targeting 2,000 tonnes of output per year by 2026, with plans to scale far beyond.

USA Rare Earth, not to be outdone, just launched the first fully domestic rare earth magnet production facility in Stillwater, Oklahoma. At 310,000 square feet, this site isn’t just symbolic — it’s a critical link in breaking dependency on China for magnetics used in everything from missiles to MRI machines.

Together, these projects mark a rare alignment of capital, capacity, and policy. Will it finally move past handwringing to real world?

With this perfect ‘domino alignment’, it’s no longer about ambition; it’s about EXECUTION. And we’re here for it.

From wastewater to white gold: Pennsylvania’s lithium revolution

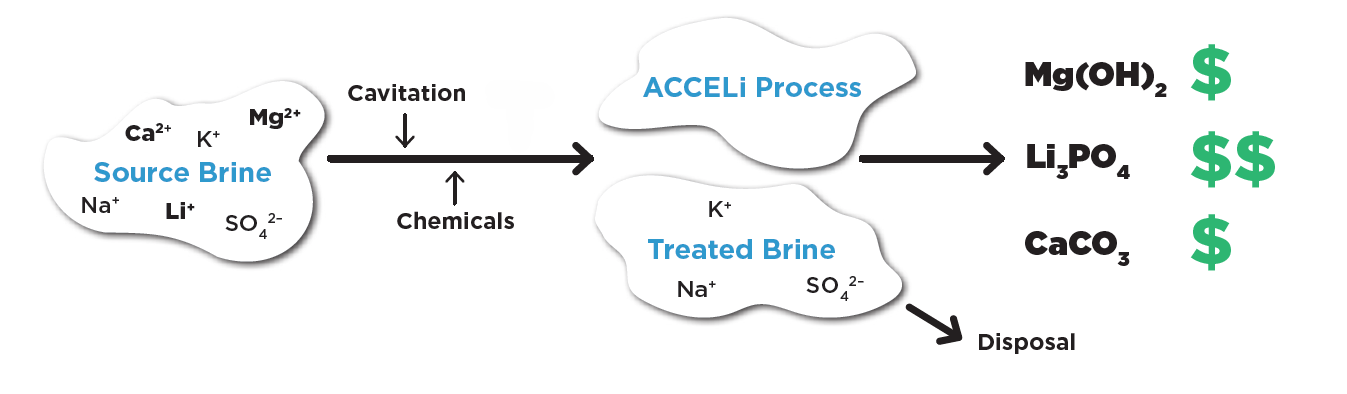

Lithium from fracking wastewater? That’s the pitch from Avonlea Lithium, whose ACCELi technology in Pennsylvania has outperformed early expectations. If scaled, it could supply up to 40% of U.S. lithium demand — no mining required.

What makes this even more compelling is the dual benefit: lower environmental impact and localized, low-cost extraction. With additional sites in Texas under review, this isn't a fluke — it’s a model.

Decentralized mineral production, with high tech and ESG as imperatives, should be the ‘new normal’ – this is the future required to transition from our current energy matrix.

With lithium prices plunging and geopolitical tensions rising, projects like this should be prioritized by regulators and investors alike.

GM’s manganese pivot and the silicon battery arms race

General Motors is jumping on the manganese bandwagon. In partnership with LG Energy Solution, GM plans to deploy lithium manganese-rich batteries by 2028 — boasting 33% higher energy density and lower costs due to reduced nickel.

Meanwhile, BASF and Group14 Technologies are upping the game with a revolutionary silicon anode. Their battery tech delivers 4x the capacity of graphite anodes, retaining 80% performance even after 1,000 cycles under thermal stress.

Silicon has always been a battery darling — high promise, low delivery. If this sticks, their ‘drop-in’ solution could alter the competitive landscape for EV batteries and consumer electronics alike.

The race to dethrone conventional chemistries is on. Manganese-rich and silicon-enhanced batteries represent, if / when commercially successful, an inflection point in EV economics — shifting the bottleneck from supply to integration.

Things you probably missed

The saltwater battery to power your AI overlords

A Wyoming data center is betting on organic flow batteries that use saltwater electrolytes instead of lithium. The goal? Meet the ballooning power needs of AI without relying on lithium.

Let’s not understate this: data centers are projected to suck up nearly 9% of total U.S. electricity demand by 2035. These flow batteries are scalable, durable, and non-toxic.

This could redefine the energy mix for tech infrastructure. It’s not just about EVs — data storage is also power-hungry beast, and it wants its own mineral story.

Endolith's bug-powered copper extraction

Endolith and BHP’s Think & Act Differently initiative just achieved significant increases in copper extraction using microbial leaching. It’s cheap, green, and efficient — a triple win.

With 70% of global copper locked in low-grade ores, this microbial trick could rewrite copper economics and reduce pressure on primary mining projects.

Enedym’s rare-earth-free motor

Canada’s Enedym unveiled a switched reluctance motor that doesn’t use rare earths. Just good old steel, copper, and iron.

As rare earth prices remain hostage to Chinese policy, motor technologies that bypass them altogether could shift procurement strategies across the EV and defense sectors.

Technology already in pilot deployment.

In sum: What’s the play here?

U.S. is ‘quietly’ building its critical minerals base. It’s happening in Indiana, Louisiana, and Oklahoma, not just on Capitol Hill.

China is adapting, not retreating. Its 90-day reprieve is a pressure valve — not a policy pivot.

Saudi Arabia’s play is real. And with MP Materials as a dance partner, it’s not just ceremonial.

Watch the infrastructure, not just the headlines

Next week, here’s what to keep an eye on:

DoE and DoD announcements on rare earth tech grants and separation facilities

Potential export license slowdowns from China once the 90-day truce expires

European Union responses to Saudi + MP Materials collaboration — especially on magnet supply chains

Besides great exploration and mining stocks, another interesting segment that holds value is midstream infrastructure, battery IP, and vertically integrated recyclers.

Keep them on your radars – this trade war, and the ‘changing world order’ (to quote one of Ray Dalio’s greatest books), is defined by magnets, not missiles anymore.

Stay ahead with Critical Minerals Journal — where insight meets impact.

Excellent article! Question, what do you suppose the Pennsylvania lithium plant will do with the with the brine? If that disposal contains a lot of potassium it could be very harmful for water resources and wildlife.

Interesting developments, thanks for write up. So, do you think that long term these are bearish for REE investments?

As a side question, what’s your vision on titanium and rutile particularly?