[CW19] Lithium price turns? Geopolitical moves, tech breakthroughs, and market signals to watch

This week’s developments point to a deeper shift in the global critical minerals equation—one that’s reshaping industrial policy, investment flows, and national security strategies.

Despite commodity price pressures, strategic activity is accelerating. The U.S. is quietly advancing domestic supply. Europe and Asia are recalibrating partnerships. And technology breakthroughs are beginning to challenge conventional extraction economics.

From the McDermitt lithium deposit’s potential to Ukraine’s emerging role as a long-term mineral partner, we examine the stories behind the headlines — and what they signal for markets, companies, and policymakers navigating the next phase of the energy transition.

Let’s get into it.

The Oregon Lithium project

There’s a massive lithium project — flying largely under the radar — that deserves serious attention; and hasn’t gotten it potentially due to lithium’s price slump and poor market timing.

We are talking about the Jindalee’s McDermitt project in Oregon, where geologists confirmed one of the largest lithium deposits ever discovered in the U.S. — valued at up to $1.5 trillion.

With an estimated reserve between 20–40 million metric tons of lithium, it could single-handedly shift America’s lithium dependency narrative.

Currently, the U.S. relies heavily on imports — particularly from South America and China — to meet its lithium demand. The McDermitt find could become a strategic lever for EV battery manufacturing, national security, and energy independence.

However, there’s a major caveat: environmental opposition and Indigenous rights concerns. As history shows, resource booms pursued without proper consultation or sustainable planning often result in backlash and delays.

Price Pressures and Market Disruptions

Despite lithium’s strategic importance in the energy transition, its price has been plummeting since the 2020–2021 boom. Why? The usual suspects: supply-demand imbalances.

A flood of new projects — including McDermitt — has pushed the supply side upward, just as EV manufacturers and OEMs have been scaling back demand forecasts since late 2024.

Still, one thing remains unchanged: our dependency on lithium-ion batteries.

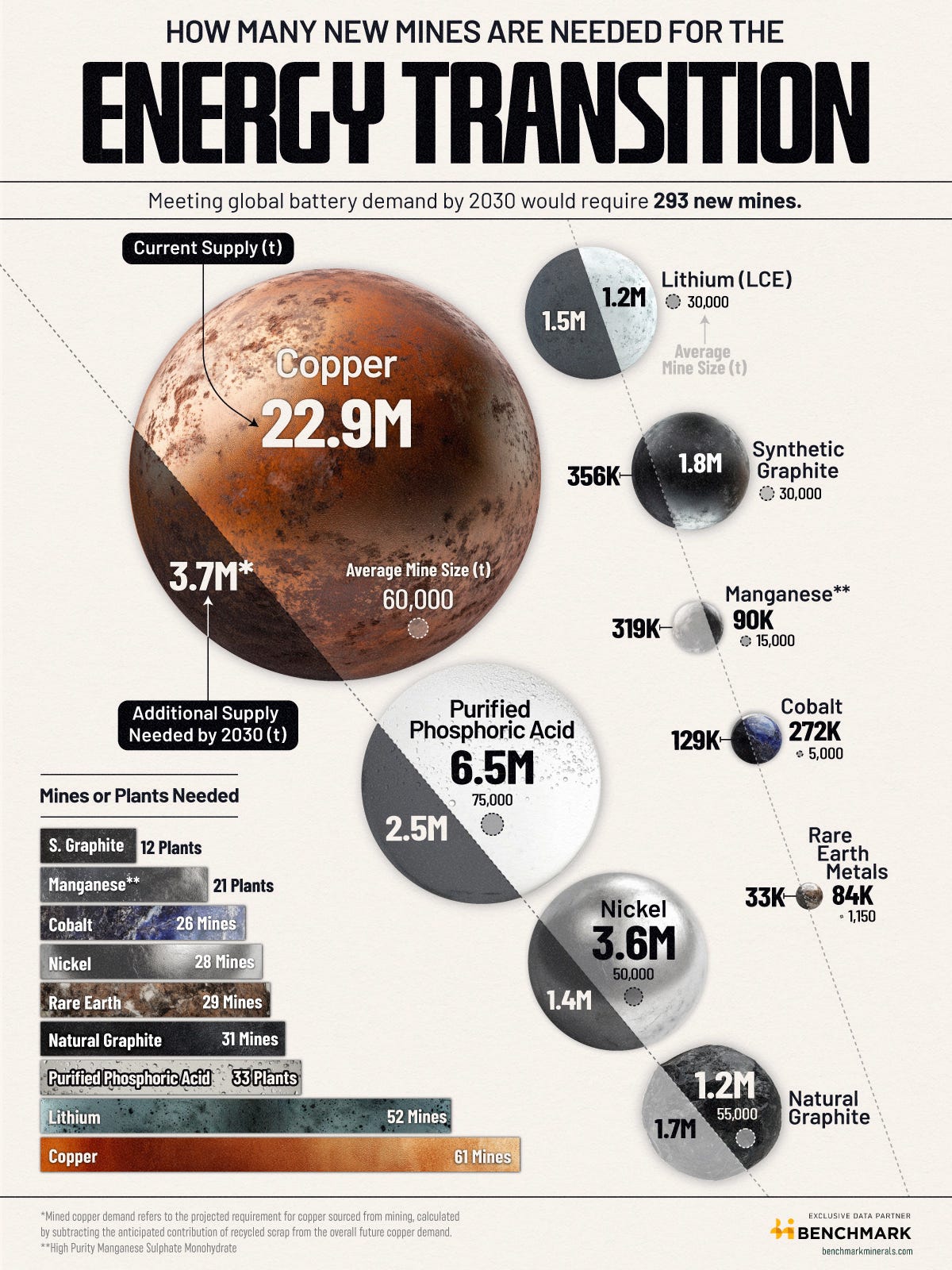

According to Benchmark Mineral Intelligence, we are far from a stable supply-demand equilibrium. In fact, an estimated 52 new lithium mines are needed to meet global demand sustainably. Fifty-two!

The Opportunity

Lithium’s current price dynamics are beginning to create attractive entry points for investors. High-quality companies with low operating costs are now trading at deep discounts.

It’s the perfect moment to keep both eyes open for opportunity — while keeping one eye on the risks.

And remember, operational efficiency is king here.

Washington’s new favorite: Ukraine’s mineral vault

While projects are being developed and new discoveries playing out, the U.S. locked in a 50/50 Reconstruction Investment Fund with Ukraine to develop its mineral base — particularly lithium, titanium, and cobalt.

Ukraine keeps ownership. The U.S. gets access.

A win-win on paper, but there's nuance: about 40% of Ukraine’s most promising mineral deposits lie in Russian-occupied territory.

This means no quick returns, but it positions Ukraine as a long-term strategic asset in the Western critical minerals playbook.

China: The Iron Grip tightens

China has added yet another layer to its mineral chokehold.

Since the tightened export permits, rare earth exports dropped 16% in April. This coincided with a high-level meeting in Shenzhen where authorities pledged to crack down on illegal mineral smuggling — especially of gallium, germanium, tungsten, and antimony.

These aren’t just minerals; they’re leverage.

Beijing is clearly signaling that it’s willing to weaponize minerals ahead of upcoming trade talks with the U.S., and American companies are already feeling the pressure — Ford notably retracted its earnings guidance, citing material supply volatility.

Domestic Defense gets offensive

The U.S. isn’t just reacting. It’s investing.

American Rare Earths confirmed high-grade samples in Wyoming, advancing the Halleck Creek project — a potential game-changer for domestic terbium and dysprosium supply.

Meanwhile, USA Rare Earth secured $75 million for its Stillwater facility, aiming to build a vertically integrated rare earth magnet supply chain.

Critical? Absolutely. These magnets power everything from EVs to drones to defense systems.

Meanwhile, in Montana, US Critical Materials found what they claim is the highest-grade neodymium deposit ever reported in the U.S. — averaging 12,000 ppm. The timing couldn’t be better.

Silicon Valley meets the rockface

Alta Resource Technologies, with backing from In-Q-Tel (yes, the CIA's VC arm), raised $10 million to scale its protein-based mineral separation platform — an innovation aiming to extract neodymium and dysprosium from waste.

The platform offers a path to sustainable sourcing, not just for the U.S., but for the entire West. It’s high science with high stakes.

Global players stepping up

In last week’s edition, we commented on Brazil’s rare earths projects surging — but make no mistake, Brazil isn’t the only one flat out in the Critical Minerals race:

India: Vedanta is ramping up exploration across several states, targeting copper, nickel, and cobalt. With new smelters and zinc alloy plants in play, India is clearly preparing to play a bigger role in the minerals game.

Canada: From the Ring of Fire to Quebec’s niobium mines (currently facing union strikes), Canada’s mineral economy is both a prize and a pressure point for the U.S. Amid murmurs from Trump about annexation (yes, really), tensions are heating up.

Turkey: Hosted the Istanbul Natural Resources Summit, advancing its rare earth ambitions, while also inking energy deals with Hungary. Ankara’s playing the diplomatic long game.

Lab breakthroughs and technical advancements you probably missed

Amprius’s 450 Wh/kg Battery

Game-changer alert: Amprius unveiled a lithium-ion battery boasting 950 Wh/L energy density — designed for UAVs and defense. This battery could redefine operational efficiency for electric aircraft, drones, and military platforms. Production capacity is already being scaled.

UT Austin’s Bio-Nano filter

Led by Prof. Manish Kumar, researchers developed a protein tube-based filter system that isolates lanthanides without toxic chemicals. This could drastically reduce refining waste, cost, and processing time — a boon for domestic REE extraction.

Munich’s ionic breakthrough

German scientists engineered a solid-state lithium-ion conductor that is 30% faster than previous benchmarks. Built from lithium, scandium, and antimony, it opens the door for safer, faster batteries that may power the next generation of EVs.

The return of promethium

At Oak Ridge National Lab, researchers finally unlocked the chemistry of promethium — filling a decades-old knowledge gap. While still radioactive and elusive, its use in niche applications like space sensors may now evolve from theory to practice.

Takeaways, insights, and things to look ahead

Innovation may leapfrog extraction

From biomining to solid-state advances, the tech driving mineral processing is shifting dramatically. Investors, take note: The edge may not be in finding new mines, but in refining smarter and faster.China won’t go quietly

China’s dual strategy of regulatory tightening and diplomatic hardball shows no signs of slowing. If anything, expect it to use mineral exports as a geopolitical stick, not a carrot.Ukraine is a long bet with political risk

The U.S.-Ukraine mineral deal is smart diplomacy — but won’t yield results this decade unless conflict conditions improve drastically. It’s more symbolic than actionable — at least for now.Markets are catching on

High-grade finds, like those in Wyoming and Montana, and aggressive capital moves by firms like USA Rare Earth and Victory Goldfields are igniting investor interest. Expect M&A activity, JV deals, and government-backed funding to surge.Labor Disruptions

The Niobec mine strike in Quebec could worsen — keep an eye on niobium futures and downstream impacts.Deep Sea Mining Debate

With Trump’s executive order stirring controversy, expect a renewed environmental vs. economic debate on seabed extraction.

As usual, a peak at the market

Stay ahead with Critical Minerals Journal — where insight meets impact.