[CW15] Trade War gets tactical: U.S.-China Tariffs (Part II); Lithium reaching oversupply; EU advancing in the Rare Earths race; and the rise of the WILD World

First came the tariffs. Then came the minerals. Now, the gloves are off.

What started as a familiar round of tit-for-tat duties between the U.S. and China has spiraled into something far messier — a full-spectrum economic standoff with lithium, rare earths, and supply chains caught in the crosshairs. April didn’t just bring higher taxes on semiconductors and soybeans — it unveiled a new era of extreme volatile trade warfare, where critical minerals are no longer background noise but front-page artillery.

Forget VUCA or BANI — welcome to the WILD world: Whiplash, Irrational, Lopsided, Derailed. From strategic tariff hikes and retaliatory export bans to Europe’s long-awaited dance with mineral autonomy, the global race for resources has entered its next chapter — and it’s anything but dull.

Chapter 1: U.S.-China update

Current status of the ‘Trade War’

U.S. Actions:

1. April 2, 2025 – National Emergency Declaration:

President Trump signed an executive order declaring a national economic emergency

As part of this, he imposed a baseline 10% tariff on all imports into the U.S. (not only Chinese)

2. Additional China-Specific Tariffs:

China was excluded from the 90-day tariff suspension granted to other countries, making it the primary target of enhanced penalties

Tariffs on Chinese imports alone were increased up to a cumulative effective rate of 145% for select strategic goods – specific high-value or sensitive exports such semiconductors, EVs, and clean tech components

For most general Chinese goods, the effective average tariff now sits around 60%–75%, depending on the sector

China's Retaliation:

1. Reciprocal Tariffs:

On April 10, 2025, China announced retaliatory tariffs on $144 billion worth of U.S. exports – a flat rate of 125% (confirmed by China’s Ministry of Commerce)

These included:

Agricultural products (soybeans, corn, pork)

Energy products (LNG, crude oil)

Manufactured goods

2. Non-Tariff Measures:

Imposed tighter import inspections and customs delays, particularly for U.S. agriculture.

Launched new export controls on critical minerals (as we covered in last week’s newsletter):

Graphite

Gallium

Germanium

Antimony

Rare Earths

These measures restrict Chinese exports of key minerals vital for defense, clean tech, and electronics.

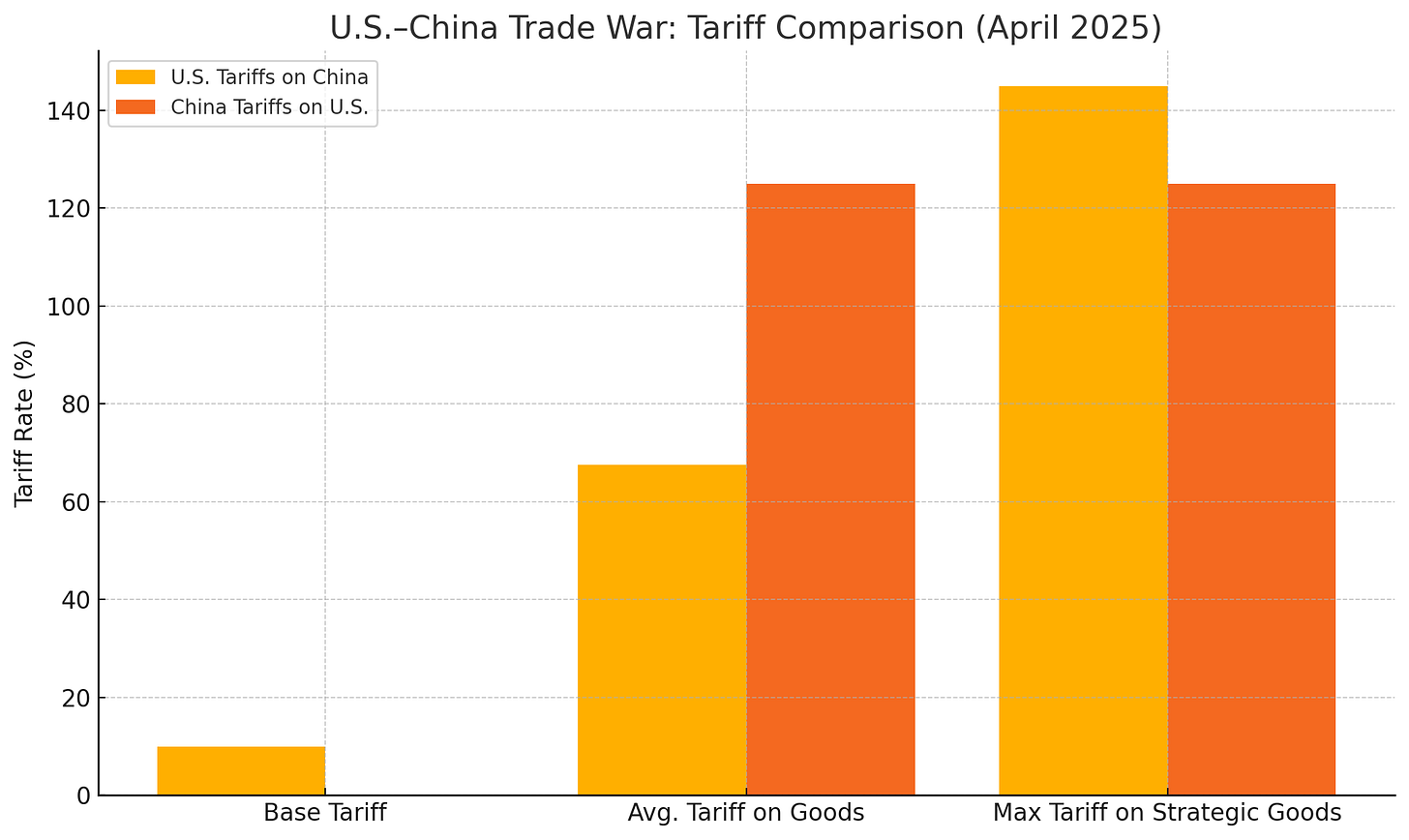

Summary of current tariffS landscape (April 13, 2025)

Base tariff: The U.S. now imposes a 10% baseline on all imports, while China hasn't implemented a global base rate—its response remains targeted.

Average tariff on goods: U.S. tariffs on most Chinese goods average around 60–75%, shown here as ~67.5%. China imposes a flat 125% on targeted U.S. imports.

Max tariff on strategic goods: U.S. strategic sectors (like semiconductors and EVs) see tariffs up to 145%, while China caps retaliation at 125%.

Exceptions and temporary relief measures

The U.S. has exempted certain electronics, including smartphones, laptops, and gaming consoles, from the new tariffs to mitigate immediate impacts on consumers and tech companies – again, to volatile to be sure how long it will last

Critical issues and strategic implications

Rare Earth Elements: Both nations are leveraging control over rare earth elements, crucial for various technologies, as strategic tools in the trade conflict.

Supply Chain disruptions: The escalating tariffs and non-tariff barriers are causing significant disruptions in global supply chains, prompting companies to seek alternative markets and suppliers.

Global economic impact: The trade war has led to increased market volatility – needless to say – with concerns over inflation and potential recessionary pressures in both economies

The bottom line? The trade tensions show no signs of abating. This isn’t a tariff war (not sure if it ever was) — it’s a full-spectrum economic standoff involving trade, tech, and critical minerals.

While certain exemptions have been made to alleviate immediate economic pressures, the broader strategic competition continues to intensify, with significant implications for global trade and economic stability.

As the saying goes: If it looks like a duck, swims like a duck, and quacks like a duck, then it just may be a duck.

And to you, what does it look like?

Chapter 2: At a slower pace than usual, as if everyone is waiting for a better definition on the Trade War

Chile reloaded: The Lithium king reclaims his throne

Just when the U.S. started flexing its lithium muscle, Chile reminded everyone who’s still boss. The country revised its lithium reserves up by 28%, adding 3.05 million metric tons from the Salares Altoandinos project. That’s like finding a forgotten briefcase filled with millions — in salt.

La Isla alone saw a 150% reserve bump, now at over 2.1 million tons. With the Chinese automaker BYD and Rio Tinto already lining up, Chile is not just back in the game — it might be calling the plays. The government’s plan to build public-private partnerships signals a more assertive industrial strategy as lithium morphs from resource to geopolitical weapon.

Europe not only joins the party but starts dancing — finally

The EU may be late to the critical minerals party, but it's bringing cash. The new Solvay facility in La Rochelle, France, will become Europe’s first rare earth processing plant. Aimed at reaching 30% self-sufficiency in rare earths by 2030, the plant is both a strategic response to China’s dominance and a lifeline to manufacturers bracing for tighter export controls.

At the same time, the EU locked in a strategic pact with Central Asia—throwing €12 billion at critical raw materials, transport, and climate projects. It’s clear Brussels is finally connecting the dots between mineral autonomy and industrial survival.

But don’t expect immediate miracles. The La Rochelle plant is still years away from impacting supply chains, and Central Asian partnerships need more than photo ops—they need roads, rails, and rules.

Kazakhstan and Tanzania: The new kids on the Critical Block

Kazakhstan came out swinging this week, announcing what could be the third-largest rare earth deposit globally — 20 million tonnes of high-grade REEs in the Karagandy region.

But there's a catch: it's not clear how much of that is actually extractable or economically viable. With development expected to take up to six years, Kazakhstan still has to prove it can turn “New Kazakhstan” into more than just a catchy PR term.

Tanzania, meanwhile, is fast-tracking partnerships with South Korea to co-develop its rich reserves of graphite, nickel, and rare earths. The pitch? Shared research, refining infrastructure, and a stable partner in a geopolitically twitchy region. It’s a smart play — if they can attract enough private capital to get beyond the PowerPoint stage.

Tech to the rescue: Lithium from batteries, not brine

In the lab-coated corner of the news cycle, Rice University dropped a game-changer: using solid-state electrolytes from EV batteries to extract lithium from water. Think of it as recycling meets nanotechnology meets alchemy. If scaled, it could seriously dent our dependency on environmentally damaging mining — and foreign suppliers.

Also waving the innovation flag is ReElement Technologies, which continues its tour of investor conferences this April. Its pitch? Closed-loop recycling of rare earths and battery metals, treating waste as a resource. Whether investors bite remains to be seen, but the timing — amid soaring demand for clean tech inputs — is impeccable.

Last week, we talked about how the University of Surrey is also bringing game-changer technologies to Lithium recycling – definitely something to keep in mind and watch closely – it has become a race.

Week’s takeaways and insight

U.S.-China trade war is expected to continue to impact the market – financial and economic volatility is a real threat for junior miners and tech startups. Only the very best funded and most credible will survive the current downturn

Global lithium jockeying is intensifying, with Chile and the U.S. in a neck-and-neck race for dominance. The EU, meanwhile, is betting big to catch up

New entrants like Kazakhstan and Tanzania add intrigue — but face uphill climbs in logistics, capital, and trust

Innovation in lithium recovery may be the most under-hyped trend. Extraction without mining? That’s disruptive

Chapter 3: Connecting the Dots

Rare Earths are no longer just rare. They’re strategic.

Beijing's countermeasures aren’t just symbolic — they’re a strategic uppercut. Investors should watch for price volatility across neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb) – the main magnetic rare earths with the highest values to a basket. Companies with domestic refining or non-Chinese supply chains (think Lynas, MP Materials, or even Solvay in Europe) are suddenly looking a lot more attractive.

Lithium is oversupplied — for now. But don’t get comfortable.

Yes, lithium prices are scraping four-year lows. EV demand has softened, and projects are hitting delays. But underneath the market gloom lies a coming deficit — 2026 and beyond look tight. That’s why projects like Thacker Pass (now funded with a $250M deal from Orion Resource Partners) are critical. Smart investors know: buy the shovels before the gold rush.

Innovation is starting to matter again.

Rice University’s solid-state lithium extraction membrane might not sound sexy, but it could change the game. If we can extract lithium more cleanly and cheaply, we’ll break the dependency on water-intensive brine mining or Chinese leaching tech. Expect startups and IP-rich companies to become acquisition targets.

Storage Is the silent winner.

The Calistoga Resiliency Center — mixing lithium-ion and green hydrogen — just locked down $28M. As energy volatility worsens (thanks again, climate change), long-duration storage will be the next hot thing. If you’re not watching this segment, you’re missing the next battery boom.

A Volatile new normal

Critical minerals are no longer a backroom discussion between geologists and engineers — they’re front-page material, caught in the crossfire of global superpowers and net-zero dreams. You’ve probably heard of the “VUCA world” (Volatile, Uncertain, Complex, and Ambiguous), or its newer cousins like BANI, RUPT, and TUNA. Well, the past two weeks have been a masterclass in all of them — So much so, in fact, that we might need a new acronym altogether:

Welcome to the WILD World

Whiplash – Irrational – Lopsided – DerailedForget VUCA. Forget BANI.

The past two weeks gave us a new flavor of global chaos — fast, illogical, and full of economic ricochets.

We call it WILD, and it’s exactly what the critical minerals space feels like right now.

As a global species, we were still nursing our supply chains back to life post-pandemic — and then boom: tariffs suddenly became the loudest word in geopolitics. A jarring setback for the flow of economic progress, just as the system was stabilizing. While the U.S. administration is clearly trying to patch up its fiscal outlook and maintain competitive edge, the short-term effect has been more shrapnel than strategy.

Meanwhile, China isn’t watching from the sidelines. It’s rolling up its sleeves and showing exactly what it’s been preparing — and in this new mineral cold war, where rare earths are as strategically important as oil once was, that’s a statement no one can afford to ignore.

Looking ahead considerations

Will China go further on rare earths export bans?

Could Europe fast-track Solvay’s processing plant rollout?

Is a lithium price rebound on the horizon? Giving that it reached a ‘oversupplied’ status and EVs demand is soaring

Ask yourself: Are your bets aligned with geopolitics — or about to be steamrolled by them?

Stay ahead with Critical Minerals Journal — where insight meets impact.